Think You’ve Got Your Credit Freezes Covered? Think Again.

Credit to Author: BrianKrebs| Date: Wed, 09 May 2018 13:36:04 +0000

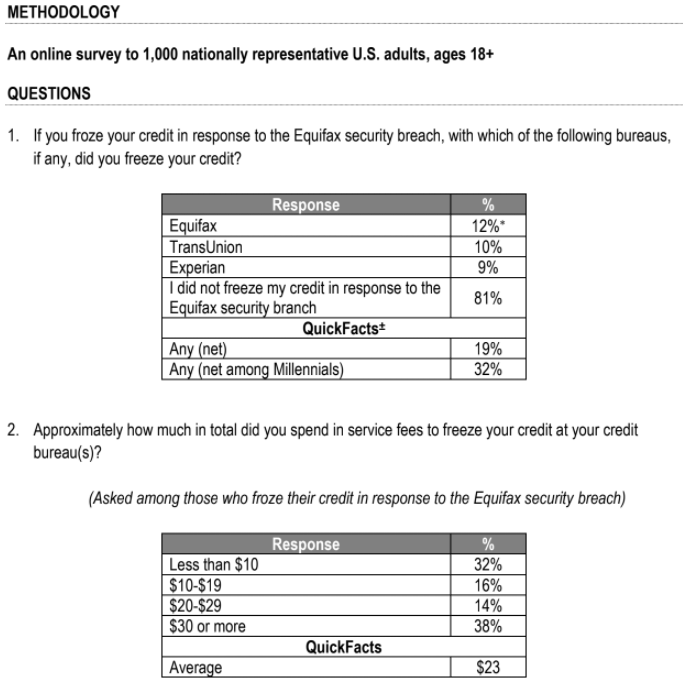

I spent a few days last week speaking at and attending a conference on responding to identity theft. The forum was held in Florida, one of the major epicenters for identity fraud complaints in United States. One gripe I heard from several presenters was that identity thieves increasingly are finding ways to open new mobile phone accounts in the names of people who have already frozen their credit files with the big-three credit bureaus. Here’s a look at what may be going on, and how you can protect yourself.

Read more