Symphony targets collaboration users outside financial services

Credit to Author: Matthew Finnegan| Date: Mon, 20 Nov 2017 11:03:00 -0800

Symphony has been called a ‘Bloomberg-killer’ since its launch in 2014 because it offers a cheaper alternative to the chat function in the popular data terminals long considered a mainstay for traders.

The secure messaging and collaboration platform started out as an in-house chat tool at Goldman Sachs, providing secure communications between employees and allowing them to easily share sensitive documents. Symphony is now valued at over $1 billion, according to reports, and has 235,000 subscribers, with users that range from traders and portfolio managers to salespeople and risk managers.

Customers include JPMorgan Chase, Citigroup, Goldman Sachs and Nomura.

But Symphony CEO David Gurle believes his company’s appeal goes further than financial market traders. Symphony is already selling to organizations in other highly regulated industries outside of financial services, such as healthcare, defense, legal and government, and wants to expand in the areas in the year ahead.

“Although our current focus is on financial services, we have a number of customers joining us from other sectors of the industry,” Gurle said. The company plans to formalize its push into other industries in early 2018.

“We believe that there are lots of opportunities within the markets where information security is very sensitive, as well as markets that are heavily regulated,” he said.

The traction Symphony has already gained in the financial services sector gives it a platform to push into other verticals, said 451 Research senior analyst Raul Castañón-Martínez. “It definitely validates their technology, so that’s an advantage for them to go elsewhere to other industries,” he said.

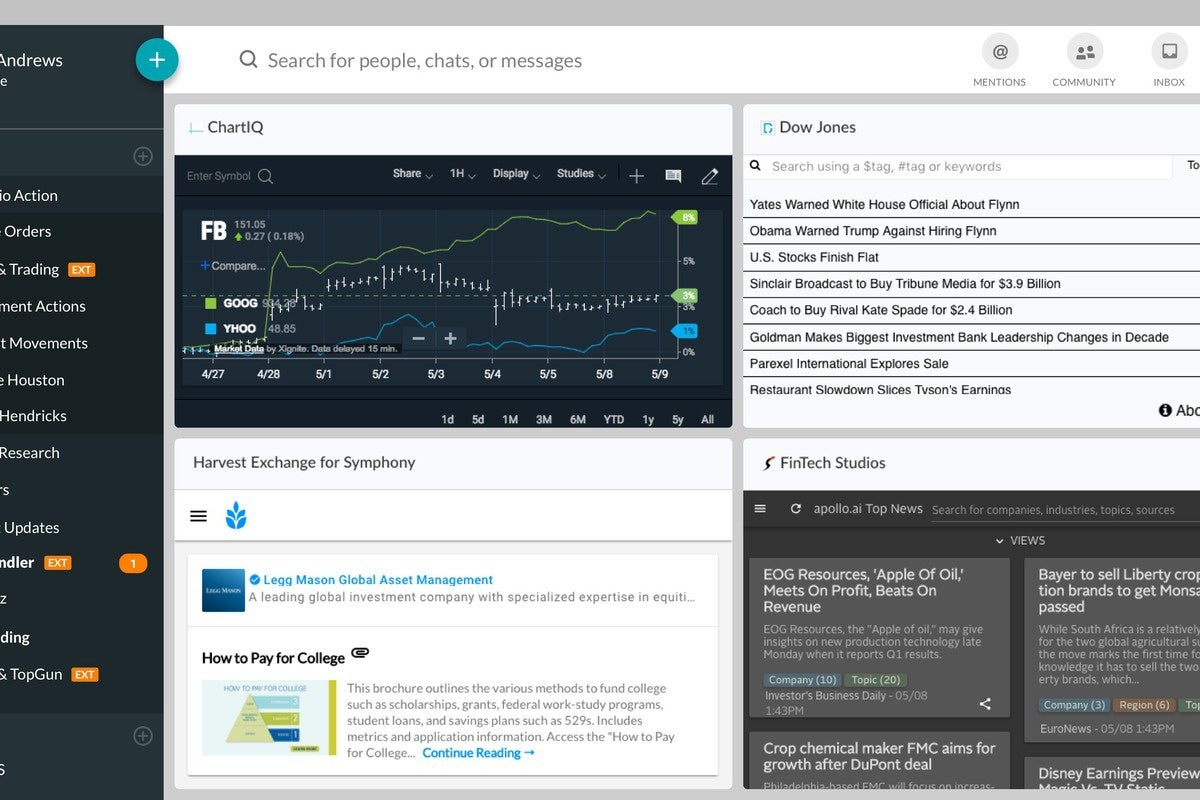

Symphony provides collaboration features that will be familiar to users of applications such as Slack. Along with basic chat functions, screen sharing, voice and video calls are supported. As is the case with other enterprise collaboration tools, Symphony also integrates with a range of third-party tools, including Box, Atlassian JIRA, Trello, Salesforce and GitHub.

Gurle called Symphony an open platform, citing integrations with data providers such as Dow Jones and a partnership with Bloomberg rival Thomson Reuters, which sells a competing terminal product, Eikon.

At its user conference in New York last month, Symphony unveiled new features, such as the ability to chat with external clients using its secure communication channel. Shared channels are now offered by many of the larger team collaboration apps, including Slack, Microsoft Teams, and Facebook’s Workplace.

The booming team messaging and collaboration market is already highly competitive. Gurle argues that Symphony has an advantage over the players that are generally not focused on regulated industries. He said the company is “kicking Slack, Skype for Business and Teams out of every account where we compete with them,” according to Business Insider, which cited an Oct. 3 internal company memo from Gurle.

Though it is targeting competitors, Symphony doesn’t see itself as a direct rival for those collaboration tools, which do not offer the same security and compliance features.

“The reason for that is that when it comes to cloud-based solution providers, the security bar and compliance bars are very, very high – it is not a high jump it is pole jump,” he said. “And the cloud service providers – whether it is Microsoft or Slack or Atlassian, or any other actually – have not designed a solution that addresses the data ownership and data protection, active compliance capabilities that the market players demand.”

One significant difference is the use of end-to-end encryption, which prevents sensitive information from being readable by any third parties until it reaches the intended destination. Those kinds of advanced security and privacy features are not yet table stakes for most collaboration tools, Castañón-Martínez said. And it remains unclear how big a differentiator those kinds of features will be.

“Slack is not really interested, at least now, in going after those type of use cases because they think they are too narrow,” he said. “I think that, in theory, Symphony could be a threat to companies like Slack, but I don’t think that is going to happen.”

“Symphony seems to be addressing a need that perhaps Slack or Microsoft Teams cannot address,” said Gartner research director, Larry Cannell. But he doesn’t expect a tool focused on secure collaboration will provide significant competition for market leaders anytime soon.

“They tend to be more expensive and this prevents them from becoming a mainstream tool, even within a company,” Cannell said. “For example, I expect there are companies that will be using … both Microsoft Teams and Symphony.”

Instead, Symphony is more likely to compete against startups with a focus on secure messaging. Examples are Raketu Communications’s SecureHaze; Dispel’s Scattergrid voice and video conferencing system; SpiderOak Semaphore; NetSfere; Scrambl3 and TeamWire.

“There are actually a good number of number of companies that I think will be direct competition for Symphony,” said Castañón-Martínez. “Most of them are smaller startups that are very specialized, that are tackling really complex technologies.”

Looking ahead, Symphony is seeking to invest cash raised from its latest funding round to add to its engineering capabilities and sales teams. Investors include Google, venture capital funds such as Lakestar and Merus Capital, and a consortium of 15 banks, among them Goldman Sachs, HSBC, BNP Parisbas, Citibank and Deutsche Bank.

“We have opened an office in Stockholm and hired a set of ex-Microsoft employees who used to work at Skype, so that has been a focus for us to build up our real-time communication stack,” Gurle said.

“The other area for us is growing our go-to market, adding more sales regions – Hong Kong, Singapore, London, Paris. We are also going to open another development center in Europe and we are working to open an office in Tokyo next year, then Australia and we will expand in South America, as well in some other parts of Asia.

“[We will] also put some essential cash aside for rainy days. just to make sure we can cater to ups and downs of the market.”