SMS Phishing + Cardless ATM = Profit

Credit to Author: BrianKrebs| Date: Fri, 02 Nov 2018 15:03:31 +0000

Thieves are combining SMS-based phishing attacks with new “cardless” ATMs to rapidly convert phished bank account credentials into cash. Recent arrests in Ohio shed light on how this scam works.

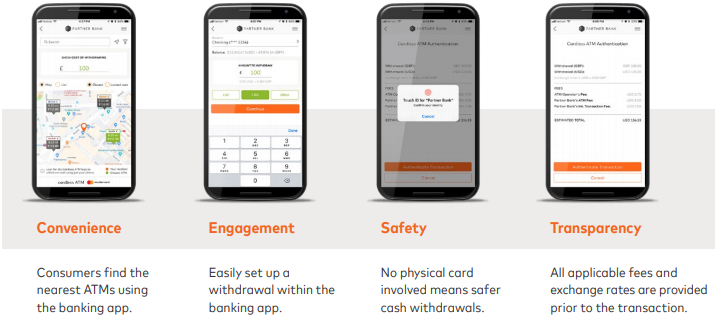

A number of financial institutions are now offering cardless ATM transactions that allow customers to withdraw cash using nothing more than their mobile phones. But this also creates an avenue of fraud for bad guys, who can leverage phished or stolen account credentials to add a new phone number to the customer’s account and then use that added device to siphon cash from hijacked accounts at cardless ATMs.

Image: Mastercard.us

In May 2018, Cincinnati, Ohio-based financial institution Fifth Third Bank began hearing complaints from customers who were receiving text messages on their phones that claimed to be from the bank, warning recipients that their accounts had been locked.

The text messages contained a link to unlock their accounts and led customers to a Web site that mimicked the legitimate Fifth Third site. That phishing site prompted visitors to enter their account credentials — including usernames, passwords, one-time passcodes and PIN numbers — to unlock their accounts.

All told, that scam netted credentials for approximately 125 Fifth Third customers — most of them in or around the Cincinnati area. The crooks then used the phished data to withdraw $68,000 from 17 ATMs in Illinois, Michigan, and Ohio in less than two weeks using Fifth Third’s cardless ATM function.

According to court documents, the SMS phishing and fraudulent withdrawals at cardless ATMs continued through October 2018, earning the scammers an additional $40,000. That is, until the bank zeroed in on four individuals suspected of perpetrating the crime spree. Shortly thereafter, four men were arrested in connection with the crimes.

One of them, identified as Ciprian-Raducu Antoche-Grecu, was apprehended in a Cincinnati suburb while standing at the same Fifth Third ATM where he was previously observed conducting fraudulent activity, investigators allege.

In January 2017, KrebsOnSecurity told the story of a California woman who saw nearly $3,000 drained from her account via a cardless ATM operated by Chase Bank. In that incident, the thieves didn’t even need to know her ATM PIN; the thieves were able to use a phone number and mobile device they controlled and associate it with her Chase account simply by supplying her username and password.

As the January 2017 story illustrates, cardless ATM scams aren’t new, but they are becoming more prevalent as more banks turn to cardless ATM technology as a convenience for customers. This time last year, cardless ATMs were offered mainly by the big banks, and then only at some of their ATMs. Now, many smaller regional and local banks have upgraded their cash machines to enable the new technology.

Card giant Mastercard says its polling (PDF) suggests that 78 percent of consumers would rather use a cardless ATM solution than carry a physical card. I would wager that most U.S. cardholders still haven’t even heard of cardless ATMs, let alone could say whether or not their bank offers such transactions. Curious whether your bank supports cardless transactions? A quick online search for your bank’s name and the term “cardless ATM” should provide some clues.

In the meantime, remember never to respond to requests for personal or financial information sent via email, text message or over the phone. Phone-based phishing attacks are getting way more clever and are even snaring technology experts, as last month’s story shows. When in doubt, contact your financial institution directly either in person or by phone using the number on the back of your card.