How to manage subscription costs | Kaspersky official blog

Credit to Author: Stan Kaminsky| Date: Tue, 12 Sep 2023 09:00:54 +0000

Digital wellbeing isn’t just about privacy and protection against online scammers and equipment failure. It’s also about having some level of control over our social networks, our screen time, and what we spend on digital services. These outlays are increasingly taking the form of subscriptions. Sure, recurring payments have long been the standard for cell phone billing, music and video streaming services, watching TV and reading online magazines and newspapers, but these days you can sign up for pretty much anything, including delivery of regular consumer goods — like socks or coffee. In many cases, a subscription is the only way to get hold of apps, games, and other online stuff — ever more services are switching to this model, and the number of subscriptions is snowballing. Even automakers are getting in on the subscription game, and soon it might not be possible to turn on the seat heating or use the sat-nav without subscribing to the respective service.

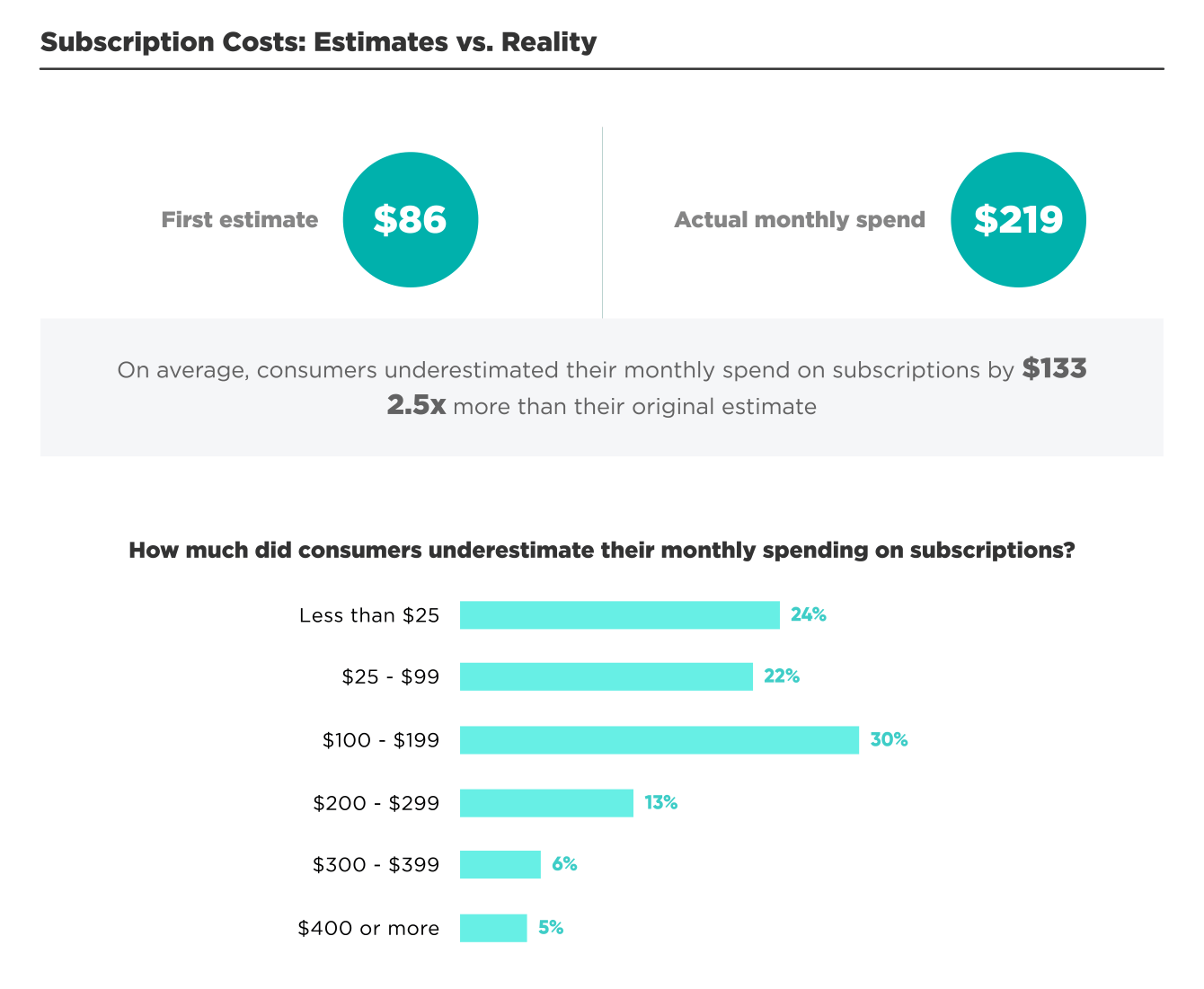

Almost everyone underestimates their subscription costs. According to this fascinating survey, the average American thinks they spend US$86 per month on subscriptions, when the real figure is a whopping US$219! And besides online, there are other recurring payments: mortgages, loans, utility bills, public transport, gym memberships and the like, all of which need to be budgeted so you don’t suddenly find yourself broke.

As trite as it sounds, how to save money couldn’t be simpler: cancel subscriptions you don’t use. No less than 42% of respondents admitted to having stopped using an app or service and then forgetting to stop paying for it. Even active subscriptions, renewed for years without change, become less economical over time: by changing your plan to a newer one, applying a promo code, or looking at competitors, you can save a lot.

But more often there’s another problem: 74% of users forget when payment is due. If the subscription auto-renews, it can burn a large hole in your pocket. If you pay manually, forgetting could result in termination of the service. And that can spell trouble if it’s your phone or something equally important.

Free trial

Another common way to accidentally fork out is by subscribing to apps and services that offer a free trial period. The service takes your card number on sign-up, but doesn’t charge you. After a week, month or whatever length of trial period, the first payment falls due. If during this time you decide the service is not for you, what are the chances you forget to go into the settings and cancel the subscription? As practice shows — very high. Such user forgetfulness is now being exploited by less-than-squeaky-clean developers who sell apps on the App Store and Google Play with exorbitant monthly fees (for example, US$90 per month for a regular calculator!). Such apps are known as fleeceware.

How to manage subscriptions properly

To get the most out of your subscriptions, plan your outlays carefully, never pay for unnecessary services, and follow a few simple rules:

- Make a general list of subscriptions so you know exactly what, when and how much you’re paying.

- Update the list as soon as you subscribe to a new service. Bear in mind that renewing a subscription may be cheaper or more expensive than the first payment — check the small print!

- Check the list on a regular basis (say, monthly) to plan your spending for the coming month.

- Checking regularly will help you remember to cancel subscriptions you don’t wish to renew. Note that to cancel a subscription it’s usually not enough to simply uninstall the app — you need to go to your personal account or to a special subsection of the App Store/Google Play to cancel it.

- Keep an eye out for sales and promotions, such as Black Friday. They often give discounts on subscription renewals.

Despite their outward simplicity, all these tips have one major drawback: they require a high level of self-discipline and attentiveness. They involve record-keeping and list-updating, and not everyone will have the time or inclination. But there is an easier, more convenient way — in the shape of a specialized subscription management service. Speaking of which, Kaspersky Product Studio recently released such an app, called SubsCrab.

SubsCrab helps you manage subscriptions and save money

SubsCrab makes it easy to keep a list of subscriptions, remember when and how much to pay, and find ways to economize.

A single glance at the SubsCrab home screen will provide all subscription details for the current month, as well as monthly outlays, due dates, and the cost of each subscription

You can add all your subscriptions to the app in one of two ways:

- Manually. You yourself select subscriptions from a long list of paid services and payment plans. There are already more than 4000 subscription services and 11,000 related plans in the database.

- Mailbox scan. The app searches your mailbox for emails from all known services, and automatically determines the plan and payment date. Email data is not sent anywhere; all processing takes place on your smartphone.

Future app updates will add two more methods:

- Bank statement scan. This feature will only work in the U.S. and some EU countries using the Open Bank API, which is supported by around 15,000 banks. As with email scanning, subscriptions will be searched for locally, and no transaction data will leave your smartphone.

- Screenshot scan of subscription page in the App Store or Google Play.

Thereby, the app also makes it easy to add new subscriptions as soon as they appear.

When all your subscriptions are in SubsCrab, the app will remind you about upcoming payments, show your total spending for the selected month or year, and help with general budget planning.

Click or tap on any subscription and you’ll see its current settings, but it’s the bottom of the card that’s the really interesting part. That’s where discount promo codes get published, plus a list of alternative services that do the same job. If you want to cut costs, you can try switching to one of these competitor services or find out how to unsubscribe.

It might sound odd, but SubsCrab itself is a subscription service. The free version lets you manually enter subscriptions from the database, choose alternative services, and get reminders and statistics.

The paid version of SubsCrab can automatically find subscriptions in your mailbox, as well as maintain and analyze multiple subscription lists — for different family members or different tasks (entertainment, work, health, etc.); only this version gives you access to promo codes for tasty discounts on your favorite subscriptions.

And if all this helps you cut costs and take control of hundreds, perhaps thousands of dollars you spend annually and unaccountably on subscriptions, the juice is worth the squeeze.